Call it a flashback to the bad old days of the U.S. foreclosure crisis.

Even as the U.S. housing recovery has continued to strengthen this year, more homes have already been lost to foreclosure than in all of 2014.

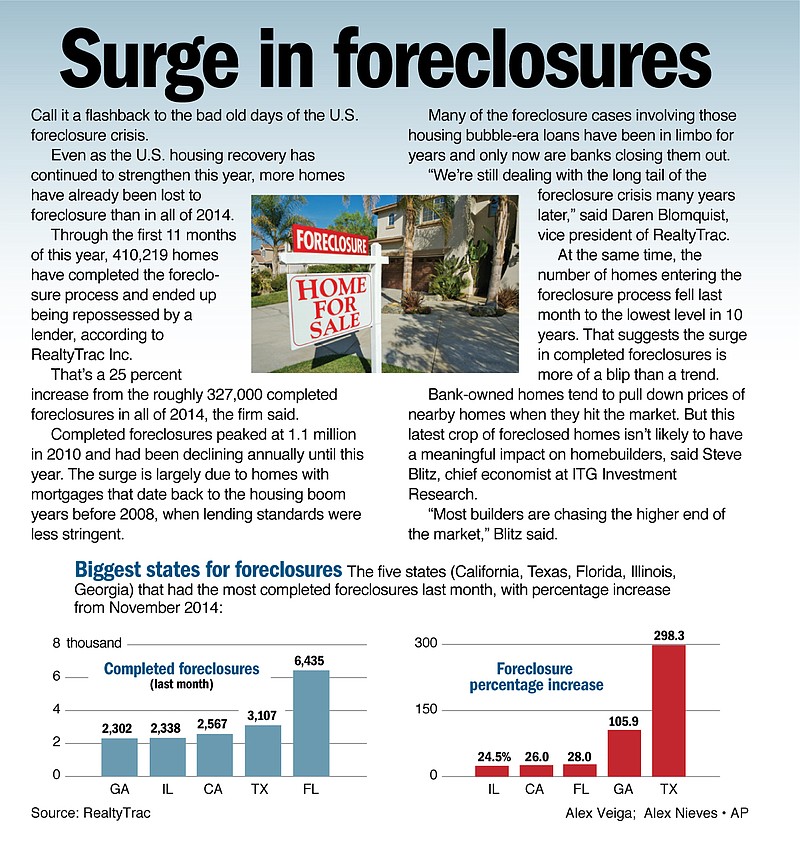

Through the first 11 months of this year, 410,219 homes have completed the foreclosure process and ended up being repossessed by a lender, according to RealtyTrac Inc.

That's a 25 percent increase from the roughly 327,000 completed foreclosures in all of 2014, the firm said.

Completed foreclosures peaked at 1.1 million in 2010 and had been declining annually until this year. The surge is largely due to homes with mortgages that date back to the housing boom years before 2008, when lending standards were less stringent.

Many of the foreclosure cases involving those housing bubble-era loans have been in limbo for years and only now are banks closing them out.

"We're still dealing with the long tail of the foreclosure crisis many years later," said Daren Blomquist, vice president of RealtyTrac.

At the same time, the number of homes entering the foreclosure process fell last month to the lowest level in 10 years. That suggests the surge in completed foreclosures is more of a blip than a trend.

Bank-owned homes tend to pull down prices of nearby homes when they hit the market. But this latest crop of foreclosed homes isn't likely to have a meaningful impact on homebuilders, said Steve Blitz, chief economist at ITG Investment Research.

"Most builders are chasing the higher end of the market," Blitz said.