DALLAS, Texas -- Danny Feldman has spent his adulthood navigating the Dallas startup scene. But a criminal record from a teenage drug possession arrest has thwarted his entrepreneurial potential.

As Feldman searched to start a new business, he turned toward the more than 70 million other Americans with a criminal record and co-founded FRSH.

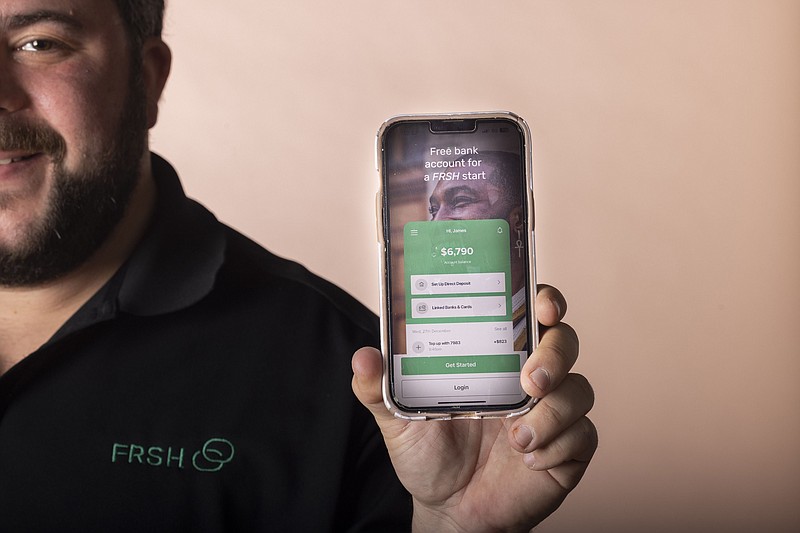

The new fintech company created by and for justice-impacted people works to create access to modern banking products and services that those with criminal records often are excluded from.

The mobile platform gives users an FDIC-insured bank account and debit card that's later mailed to their homes. FRSH doesn't ask for background checks, credit checks, proof of income or a minimum balance to open an account.

"We wanted to make sure that no matter what your background, you have equal access to financial tools and banking so that you don't have to continue using these predatory lenders," said Feldman, FRSH's chief executive officer.

Without a bank account, up to 13% of paychecks are eaten by fees at cash checking sites. It's nearly $4,000 a year for formerly incarcerated workers in Texas. FRSH's goal is to get 500,000 justice-impacted people not cashing their checks within five years, returning $2.2 billion annually to the community.

Nearly three-quarters of formerly incarcerated people do not have a bank account for the first three years after they're released, Feldman said.

People with criminal convictions often struggles with accumulated debt, inactive accounts at large banks and poor credit scores after spending years incarcerated.

"FRSH is disrupting the financial services industry with next-gen technology that opens the door to a community that needs more help now than ever before," said Chris Heckler, the company's president and co-founder.

Financing a new beginning

The personal finance platform hopes to make it easier for people who are trying to get back on their feet to pay their bills and fines and reduce recidivism, Heckler said.

After prison, the average debt from court-related fines and fees was $13,607, about the same as the projected annual income for people with felony convictions, according to Who Pays, a national research project led by the Ella Baker Center for Human Rights and Forward Together.

"Without the proper tools in place, it can take people years," Feldman said.

In a pre-seed financing round in late 2021, FRSH raised $650,000 from angel investors in Dallas. Since then the app has raised nearly $1.3 million. The company makes money by charging interchange fees on debit card transactions.

The app went live in October and has 1,100 users. By the end of the year, the founders hope to reach 10,000.

FRSH was one of ten startups selected for Village Capital's Justice Tech Fellowship Program last fall, which aims at supporting companies that are working to reduce recidivism and make transitioning back into society easier.

Feldman was paired with Topeka Sam as his mentor, a formerly incarcerated and well-known justice reform advocate, who runs nonprofits that have raised more than $11 million in five years.

Sam would soon become Feldman and Heckler's third co-founder and chief visionary officer. "It's a very unique partnership because it shows that no matter where you come from, the system affects us all," Sam said.

After selling drugs in college, Sam stopped for seven years as she was working for Amtrak and pursuing other businesses. Then one night she got a call about doing one more job and was arrested as a part of a federal sting operation.

Unlike many women she met in prison, she had a deep understanding of personal finances and gave her parents power of attorney and was able to keep her bank account. When she was released three-and-a-half years later, her parents were able to help her rebuild her credit.

Sam views herself as among the privileged bunch. But she still finds herself facing prolonged financial obstacles due to her felony conviction, especially when it comes to scoring loans.

"If me, the person who is 'the poster child of success from incarceration' is still going through these barriers, then what are people who do not have the same privilege or opportunities that I do, what are they experiencing?"

Sam joined FRSH to resolve barriers formerly incarcerated people like herself experience in banking.

"I've been the person that if I don't see a solution, I like to build it," Sam said.

Feldman as a founder

As a junior at the Episcopal School of Dallas, Danny Feldman lost his mother to a drug and alcohol addiction. He was 17, unsure how to react, and found himself getting in trouble, he said.

He was arrested in 2004 for drug possession and took a plea deal that helped him avoid jail time but resulted in a felony conviction.

Feldman had a scholarship to go to Hofstra University in New York, but he wasn't able to make the move because of his probation. When he applied to nearby schools, he wasn't accepted because of his background check, he said.

"Effectively, my ability to meaningfully participate in the economy completely evaporated," Feldman said. "I couldn't get a job, couldn't get a house."

At one point, Feldman was among the 6 million people cashing his paychecks and using payday and title loans.

Feldman found a job with Cutco Cutlery, a kitchen knife manufacturer, that agreed to give him a second chance. The company put him through its management training program to become an entrepreneur.

"Which was basically the only thing that I could do, which is what many of us do."

In his 30s, he left Cutco to co-start Stellar, a Dallas property technology company that uses AI and machine learning to address maintenance issues at scale for the single-family rental market.

He helped found Stellar from his kitchen table in 2016 and by the third year had 50 employees and roughly $50 million in sales. After Feldman left the group with a decent chunk of equity, Stellar raised $20 million in their Series B financing round.

Distributed by Tribune Content Agency, LLC.